VAT Automation System (VATA)

Overview

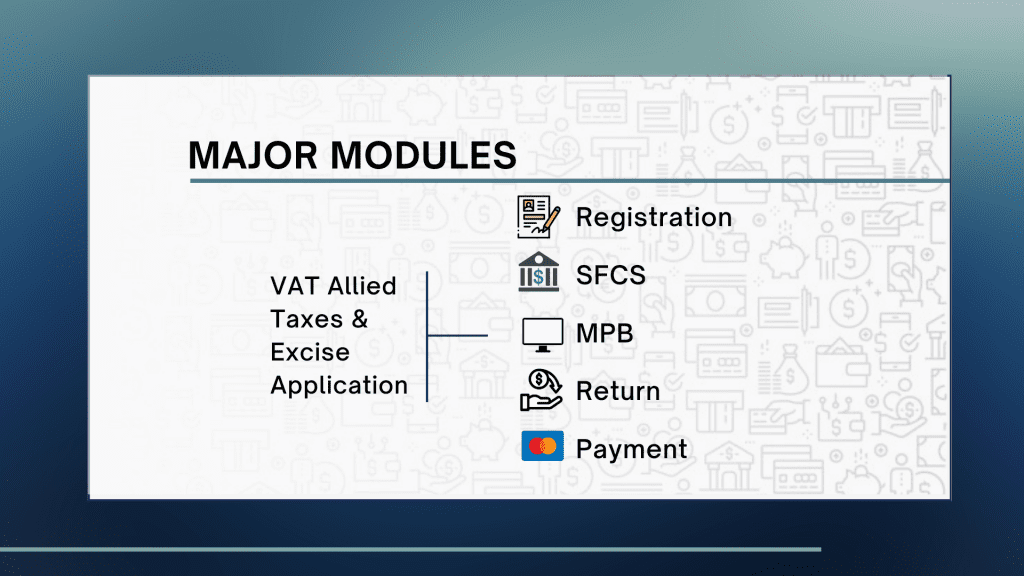

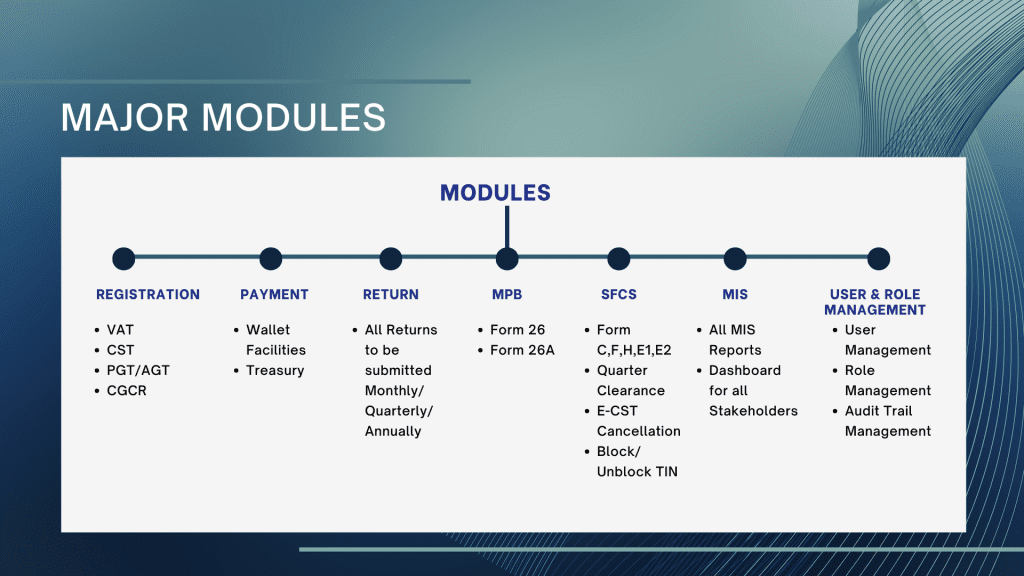

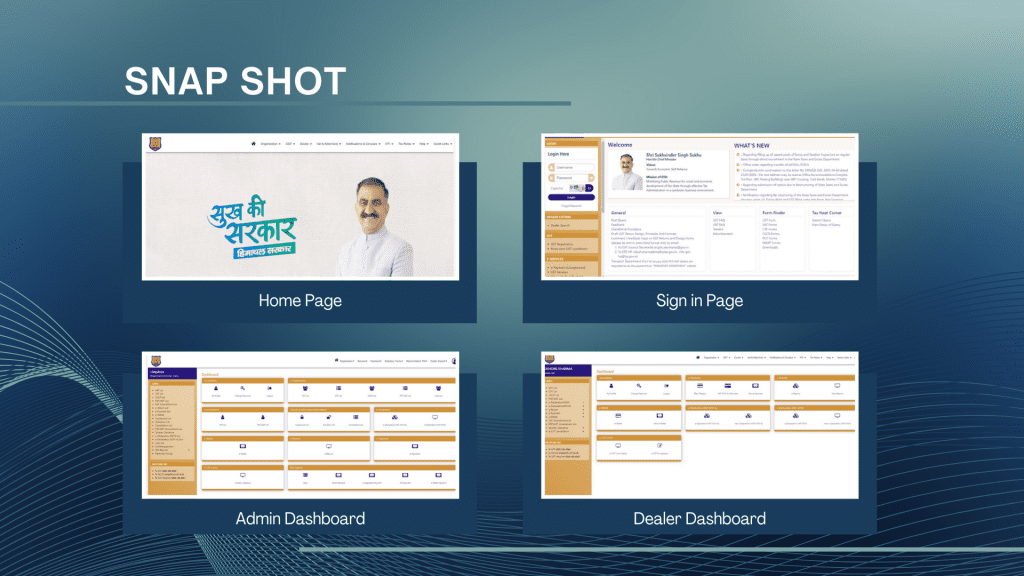

The open-source technology-based VAT Allied Taxes & Excise application is an all-encompassing solution designed for end-to-end processes for all stakeholders, including VAT and state officers. Dealers undergo registration via the portal and proceed to complete the return, payment, MPB, and SFCS.

Dealer registered for VAT/CST/PGT/CGCR through the application. After the successful Registration a TIN number is generated. Subsequently the registered Dealers fills the Return Forms which need to be submitted monthly/quarterly/yearly. The return the payment will be done from treasury and e-wallet.

Product-Coverage

- VAT

- CST

- PGT/AGT

- CGCR

- Amendment

- Conversion 14(2) to 14(1)

- Suo-Moto Registration & Cancellation

- Cancellation

- Suspension

- Treasury

- All Returns to be submitted Monthly/Quarterly/Annually

- Form 26, 26A

- Quarter Clearance

- E-CST Cancellation

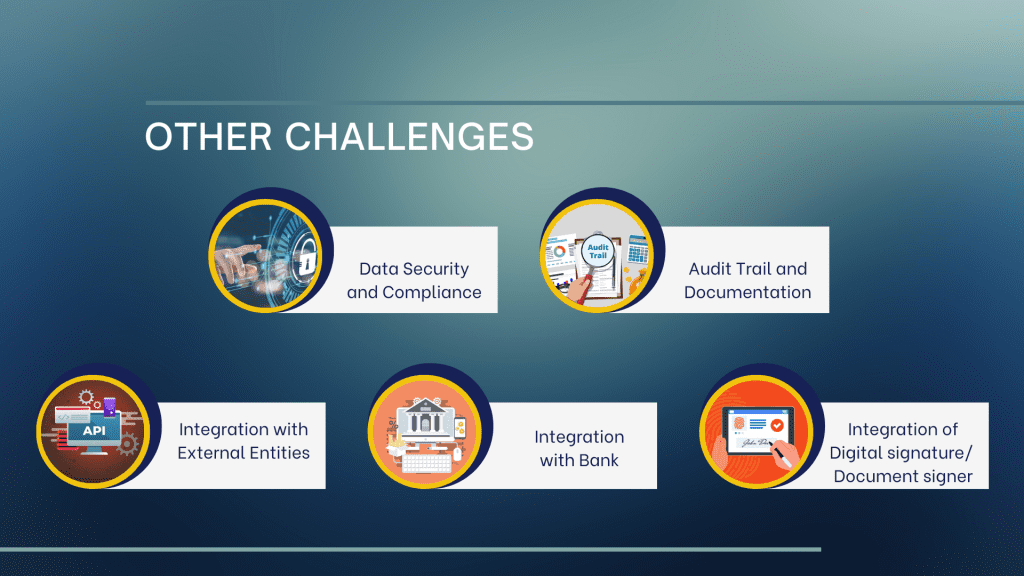

- User & Role Management

- Audit Trail Management

- All MIS Reports

- Dashboard for all Stakeholders

Our Clients

Department of State Taxes & Excise (Govt. of Himachal Pradesh)